OTC securities market in Russia and abroad. Exchange and OTC securities market in Russia - abstract

Introduction

The OTC, or primary, market is an independent market with its own methods of placement, a rather complex and extensive mechanism of placement and intermediation, which, unlike the exchange, does not have its own trading place.

The peculiarity of the OTC market is that it passes through itself new issues of bonds, which then go to the stock exchange during their subsequent purchase and repurchase. The vast majority of new bonds are not returned to the exchange and are in the hands (assets) of credit and financial institutions.

The main role of the OTC market is related to bond trading. However, it also sells shares; in these cases, investment banks, banking houses, and specialized brokerage and dealer firms usually mediate.

At the present stage, the role of the exchange in securities trading has somewhat decreased. The main reason for this is the formation of powerful credit and financial institutions, which concentrated the vast majority of securities trading without the intermediary of the exchange, as well as the transfer of bond trading almost entirely to the OTC market.

On the OTC market is the placement of first issued securities. Its main participants are issuers of securities and investors.

.OTC securities market: role, functions, structure, characteristics of participants

OTC Market -this is the term used to describe transactions with securities concluded outside the exchange. This market can also be a network of dealers selling and buying securities. In the OTC market, there is also the opportunity to enter into transactions with securities using the Internet. In this market, the purchase and sale of financial instruments and services is carried out, transactions for which are not registered on the exchange. The OTC market is characterized by a much more significant level of financial risk. This factor is caused, firstly, by the absence of the traditional procedure for strict qualitative selection of financial instruments and services (this procedure is called listing on the exchange), and secondly, there is no intermediary in the form of an exchange in the transactions that would assume the risks of non-execution of transactions with parties to counterparties. On the other hand, this market provides the circulation of a wider range of financial instruments and services, satisfies the demand of individual investors in financial instruments with a high level of risk, and therefore - brings higher returns. Some of the operations with securities, as well as a significant amount of credit and insurance operations are carried out in an unorganized financial market. OTC turnover has emerged as an alternative to the exchange, since many companies do not have the opportunity to enter the exchange, because of which their indicators do not meet the requirements for their registration. OTC turnover arises as an alternative to the exchange. Many companies cannot enter the exchange, as their indicators do not meet the requirements for their registration. It should be noted that in the OTC turnover the lion's share of all securities on the market is traded. These are usually shares of small firms operating in traditional industries, as well as companies of the new economy, potentially capable of becoming the largest corporations, etc. Access to the OTC market makes it possible to diversify the structure of the investment portfolio, increasing its profitability using alternative investment tools. This function is addressed to customers interested in working with exchange-traded securities, as well as with less liquid stocks and bonds of promising issuers of medium and small capitalization. A significant part of the securities of a large number of companies that have not passed the listing procedure on the stock exchange, in particular: shares, bonds, bills, derivative financial instruments, is traded on the OTC market. Listing Securities - the procedure for listing the securities by the stock exchange in the quotation list (list of securities admitted to exchange trading), as well as monitoring the compliance of securities with the conditions and requirements established by the exchange. Transactions in the unorganized OTC market are carried out according to agreements between counterparties. In contrast to the OTC market, the stock market, regardless of where and how it is carried out and organized, has its own characteristics. First of all, he acts as a market for a narrow circle of professionals: brokers, dealers. Not all issued securities are traded on the exchange market, but only a certain part of the most regularly traded ones, which are in stable demand and interest from professional participants in the exchange. Only those securities that have been listed will be accepted on the stock exchange, that is, only after a sufficiently deep analysis of the issuer's financial condition and quality of the security. The range of securities not traded on the exchange is much wider. For example, the US government bond market and the international Eurobond market appear as over-the-counter. The OTC market is “less professional” and, based on this circumstance, is practically publicly available, capable of ensuring the direct participation of millions of small and medium-sized investors in securities trading, and hence in the investment process. The circulation of any security on the exchange or over-the-counter market is mediated not only by the “meeting” of demand and offers of professional market participants and the issuer, but also by market traditions, the specifics of its infrastructure, and the history of regulation. At this time, there is no consensus regarding the advantages or disadvantages of the OTC markets where a large part of the bonds and stocks are traded, mostly small companies. In some states, off-exchange trading does not have a significant role, and in some it is even prohibited. A well-organized over-the-counter market does not lag behind the stock market in terms of the convenience of transactions and settlements between securities and market professionals, as well as the level of technology used by market participants to exchange information, enter into transactions and settle transactions. The need for the functioning of the OTC securities market is explained by the fact that many shares of small and medium capitalization companies are circulating on it, whose sizes have not yet reached exchange standards, primarily in terms of the volume of securities issued and their degree of reliability. The OTC market is often compared to an incubator, where companies are nurtured, whose shares eventually gradually move to the stock exchange. The OTC market, unlike the exchange, is not localized, that is, it is not tied to some structure, representing a closely interconnected network of brokerage firms that conduct operations with securities. The scale of OTC markets varies significantly depending on the country, their functioning. In the USA, the OTC market is almost equal to the central New York Stock Exchange in terms of value of transactions, while in Japan, its turnover occupies only a small fraction of the total exchange turnover. OTC trading of securities is conducted through personal and telephone contacts, as well as through the electronic OTC market, which includes special computer telecommunication systems. Technical progress has led to an incredibly rapid development of over-the-counter trading, which is more flexible, cheaper and more effective, even in terms of basic characteristics, of information transparency, guarantee, reliability and inferior to exchange trading. The lower reliability of the OTC market creates clear preconditions for exchange trading, especially for individual investors Thus, in our time - the time of rapid development of securities trading technologies and automated settlements, creates favorable conditions for the development of both exchange and over-the-counter markets, and the use of Internet trading opens up equal opportunities for everyone. The main infrastructure elements of an organized over-the-counter market are: depository, which performs the functions of settlement, with a wide range of ongoing depository operations, in particular, operations “delivery / receipt of securities against payment”; one or several leading market makers who quote and support the market; information and trading system (s) for receiving / quoting and concluding transactions (for example, Bloomberg and Reuters Dealing); general trading and settlement regime, including the procedure for concluding transactions, the size of the minimum lot, the timing and procedure for settlements. OTC trading is carried out by professional securities market participants: brokers and dealer companies, which, however, often combine their functions. Broker - is a sales representative, legal entity, professional participant in the securities market, who has the right to carry out operations with securities on behalf of the client and at his own expense or on his own behalf and at the expense of the client on the basis of onerous agreements with the client. Dealer (on the securities market) - is a professional participant in the securities market, performing operations with securities on its own behalf and at its own expense. According to Russian law, only a legal entity can be a dealer. There are two types of dealer licenses: · For operations with corporate securities · On operations with government securities To ensure guarantees for the execution of transactions, the dealer must have sufficient equity, the minimum value of which is established by law. The dealer, if desired, can combine his activities in the securities market with brokerage. By law dealer is required:

· Act only in the interests of customers; · To provide its customers with the most favorable conditions for transactions; · Disclose to customers all the necessary information about the state of the market, issuers, supply and demand prices, risks, etc .; · Prevent price manipulation and incentives to conclude a transaction by providing intentionally distorted information about issuers, securities, price dynamics, etc .; · Carry out transactions on the purchase and sale of securities in accordance with the instructions of customers in the priority order in relation to dealer operations, if the dealer combines its activities with brokerage. The dealer can receive income in the form of: · Spread (the difference between the stated purchase and sale prices); · Commissions · Rewards for consulting and providing information. In over-the-counter circulation there is no single physical center for operations. Sales transactions are conducted through telephone as well as computer networks. Prices are negotiated, according to the rules governing the OTC turnover, which are less stringent in comparison with the rules of trade operating on the exchange. The OTC securities market is automated, which enables its buyers and sellers to monitor the announced current prices in a competitive environment, in addition, all purchase and sale prices with the names of participants in the trade are displayed on the screen. Applications are executed as information is received. In the OTC market, most firms act simultaneously as brokers and dealers. Combining the functions of a broker and a dealer in one transaction is not allowed. 2.

Foreign experience of the OTC securities market

Today, the securities market is structurally composed of the primary (over-the-counter) market, the stock market (stock exchanges), and the street market (“over the counter” market). The primary market includes only new issues of securities, mainly bonds of commercial and industrial corporations. Numerous intermediaries work on it in order to place the issue of new securities, namely: investment banks, brokerage firms, banking houses. Brokerage company - This is a company (a professional participant in the securities market) that is engaged in brokerage activities. Brokerage activity - this is the activity of making civil transactions with securities and (or) concluding contracts that are derivative financial instruments, both on behalf of the client on behalf and at the expense of the client (including the issuer of equity securities when they are placed) or own name and at the expense of the client on the basis of onerous contracts with the client. If we evaluate the quantitative as well as the value ratio of the OTC and exchange markets in Western countries, then we should assume that the OTC market exceeds the exchange market in quantitative terms. At the same time, in value terms, the exchange market is larger than the over-the-counter market, since the stock exchanges have accumulated significant volumes of expensive stock values \u200b\u200bin the form of shares. The degree of development of primary securities markets is very diverse and is determined by: the degree of development of the economy as a whole; credit and financial system; the established tradition of the securities market and the accumulation of money capital. Primary markets are most developed in the USA, Canada, Great Britain, Japan, and Western Europe, since it is in these states that the most active flow of money capital through securities. The main part of the sources that are used to renew fixed capital and introduce innovations in the corporate sector is precisely the issue of bonds and shares, and to a lesser extent - bank loans. In Russia, the primary market is poorly developed, since the tradition of selling securities through the stock exchange is quite strong. In fact, the primary market is divided into the market for private corporate bonds (from 70-90%) and the stock market (from 10-30%). About 80-90% of corporate financing is provided through the primary securities market. An important feature of the primary securities market is the specific mechanism for their purchase and sale. The main role here is played by large investment banks (as, for example, in the USA and Canada), commercial banks (especially in Germany), as well as banking houses and large brokerage firms. The most common is the placement of a bond loan (underwriting) by subscription between the issuer and the investor, which is played by investment (as in the USA or Canada) or commercial (as in Western Europe) banks. These banks realize the issue of private bonds, receiving commissions in the amount of a fixed percentage of the value of the bonded loan, as well as commission for advising on the placement, if agreed. A feature of the primary market is the placement of securities through intermediaries, which are investment banks. The relationship between the issuing company and the investment bank is built on the basis of an issue agreement. Investment banks, together with the issuing company, determine the terms of issue (amount of capital, terms and methods of placement of securities, etc.), then they are already placed. The primary securities market in the United States is the bond market, as private bonds of corporations account for 70-80% of the issue of all securities, and the proportion of shares is from 10 to 30%. Such a balance in the market allows attracting huge long-term financial resources for large corporations in order to renew fixed capital and implement the latest technological processes based on the latest achievements. As the clearest example of over-the-counter securities trading in the United States, you should first of all illustrate the automated system of the National Association of Securities Dealers (NASDAQ), which was organized back in 1971. Its goal is to provide OTC dealers and brokers with information about through this securities system. Membership in NASDAQ necessarily requires companies to register their securities in accordance with applicable law, as well as their compliance with stringent requirements in such parameters as: amount of assets, profit, number of shareholders, number of shares placed, their rate, etc. Brokers who buy or sell shares sold through NASDAQ look at quotes published weekly on NASDAQ newsletters, or on the so-called “pink sheets”, in constant search of the best prices for execution. In 2011, the Russian IT giant, Yandex, placed its shares on the Nasdaq stock exchange during the IPO (Initial Public Offering - the first public sale of shares in a joint stock company, including in the form of the sale of depositary receipts for shares, unlimited number of persons) $ 1.435 billion 3.

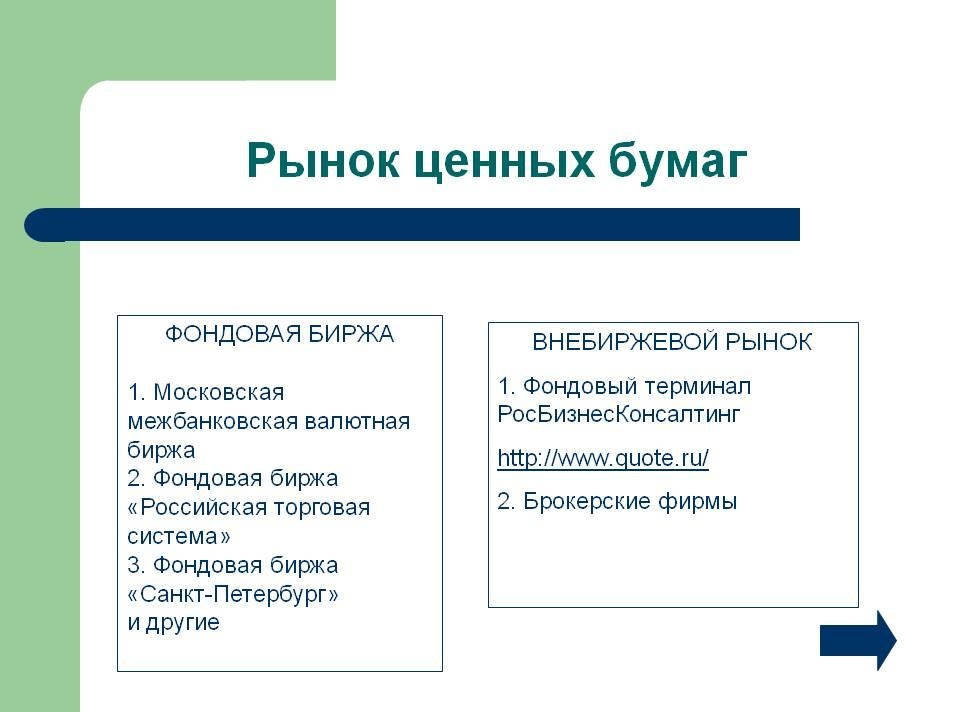

Tendencies and prospects for the development of the OTC securities market in Russia The Russian OTC securities market is represented by the following structure: · The system of trading in government securities; · Trading network of a savings bank; · OTC securities market of commercial banks; · Electronic over-the-counter markets; · The Russian trading system (RTS "Portal"), which is organized by the professional association of stock market participants (PAUFOR). Each of these types of OTC markets is characterized by specific features. In Russia, the organizational center of OTC turnover is the Russian Trading System (RTS), which combines broker and dealer companies. As an initial version of the OTC trading system - the "Portal" - one of the subsystems of the US OTC trading system NASDAQ was adopted as a basis. The technical equipment of the Portal was improved by Russian specialists, and the system received its current name “Russian Trading System” (RTS). Until recently, the largest OTC system in Russia (which is licensed by the organizer of securities trading) was the RTS, which received the status of an exchange. Initially, the system was focused on serving 50 traders working from remote terminals. However, subsequently, this trading system has spread to other regions of Russia. Members of other self-regulatory organizations, in particular the Association of Stock Dealers of Siberia, the St. Petersburg United Trading System, can use the Russian trading system. Ural Association of Brokers and Dealers. The main object of trade transactions on the RTS are shares of the largest Russian enterprises, such as RAO UES, RAO Norilsk Nickel, AO Yuganskneftegaz, and NK LUKOIL. In total, 13 large companies are in the main listing of RTS. The OTC market in Russia can operate successfully using a central settlement depository, and in its absence, using one of the developed bank depositories. A solid and reliable bank depository, which is focused on the development of a client business, innovative in terms of technology, can provide the full range of depository services that customers need. Such a depository provides customers with the opportunity to make settlements on securities in the form of “delivery / receipt against payment”, guaranteeing the fulfillment by counterparties of counter obligations in the transaction of purchase / sale of securities. The depositary's responsibilities also include ensuring the timely payment of income on securities. He also provides information services to clients at a high level and is able to protect the legitimate rights and interests of clients. The active growth of the over-the-counter sector is due to two more reasons. Of these, the first lies especially in the taxation of participants in the stock exchange and OTC market. When making a transaction in an organized market, a broker acts as a tax agent, and all the difficulties of paying personal income tax fall on his shoulders. If the trade is on the OTC market, then legal entities and individuals act as tax agents. This feature of taxation provides an opportunity to hide part of the amounts paid by tax clients, which in turn can lead to a shadow of income. Securities of various companies that are not included in the quotation list of organized exchanges are traded on the OTC market. As for the trends in the Russian market, the study “Investment Companies Market Overview for 2010: Off-Exchange Growth”, prepared by the Expert RA rating agency, showed that by the end of 2010, investment companies increased their total turnover and customer base by 68% and 25 % respectively. However, the growth in turnover was accompanied by the accelerated development of over-the-counter trading, and the expansion of the client base was accompanied by a decrease in the number of active customers. The total turnover of the companies participating in the Expert RA monitoring in 2010 increased by 68%, reaching the level of 62 trillion. rub. The dealership segment (giving about 10% of turnover) of the investment market grew by 114%, the brokerage sector - by 54%. The total number of registered clients of investment companies increased by 25%, reaching the mark of 365 thousand customers. However, the rapid build-up of the client base does not increase the "quality" of investors. The share of active customers, that is, customers who made at least one transaction within a month, in the total volume of the customer base decreased to 32% at the end of 2010 against 36% at the end of 2009. The increase in the total turnover of investment companies took place against the background of the outstripping growth of the OTC segment of the stock market. So, in 2010 the over-the-counter segment grew by 95%, reaching the level of 14.5 trillion. rub. The share of the OTC market in the total volume of operations increased from 20% to 23%. The stock market segment of the investment market grew by 62%. The increase in turnover in the over-the-counter sector can be called an alarming signal, since it is more difficult to control the fulfillment of obligations, the reliability of counterparties and the payment of taxes outside the exchange. However, the “shadow” advantages of over-the-counter trading against the background of a difficult merger of the two largest stock exchanges in Russia are likely to lead to further growth in unorganized trading. over-the-counter valuable investment market Conclusion

Thus, the OTC securities market is the securities market, which is organized by dealers outside the exchange. In this market are circulated mainly securities of companies that are not listed on the exchange. An organized over-the-counter market is a civilized system of servicing a certain, and, in fact, an infinitely wide range of securities. Its existence is quite justified, and, moreover, it seems necessary to strive to form such a market. Differences in the OTC market: stock quotes are indicative and are set by brokers; settlement of transactions is carried out with deferred execution; exchange commission for operations is not charged. The Russian OTC securities market is presented in the following form: system of trading in government securities; trading network of a savings bank; OTC securities market of commercial banks; electronic OTC markets; Russian trading system (RTS "Portal"), organized by the professional association of stock market participants (PAUFOR). The leaders of the OTC securities market in Russia are brokerage companies: BrokerCreditService Company, VELES Capital Investment Company, OTKRITIE Brokerage House, REGION Brokerage Company. Recently, a systematic increase in securities trading has led to an increase in the share of the OTC sector to 23% in the total turnover of companies. A further increase in the OTC securities trading sector has very real prospects. List of sources

1.Alekhine B.I. Securities Market: Textbook. manual for university students / B.I. Alekhine. - 2nd ed., Revised. and add. - M.: UNITY - DANA, 2010. 2.Federal Law of April 22, 1996 “On the Securities Market” .Basic course on the securities market: a training manual / O.V. Lomtatidze, M.I. Lviv, A.B. Bolotin et al. - M.: KNORUS, 2010 .Burenin A.N. Securities and derivatives market. M .: NTO them. S.I. Vavilova, 2002. .Burenin A.N. Forwards, futures, options, exotic and weather derivatives. M .: NTO them. S.I. Vavilova, 2005. .Titman L.J. Jonk M.D. Fundamentals of investing: Per. from English M .: Business, 1999. .McConnell K.R., Bru S.L. Economics: principles, problems and politics / trans. from English: in 2 vols. M .: INFRA-M, 2007. .Mirkin Y.M. Securities Market: Textbook. allowance. M .: Financial Academy, 2002. .Stock market. Beginner Course \u003d An Introduction to Equity Markets. - M .: "Alpina Publisher", 2011. - 280 p. - (Reuters for financiers). .Sviridov O.Yu. - Money, credit, banks: textbook. allowance. M .: March, 2008. .Fundamentals of investing. Gitman L.J., Jonck M.D. Textbook - M .: Delo, 1997. - 1008 p. .Mishkin F. Economic theory of money, banking and financial markets: Textbook for universities / Per. from English D.V. Vinogradov, ed. M.E. Doroshenko. - M .: Aspect Press, 2006 13.Exchange and OTC markets. - [Electronic resource]. - Access mode: # "justify"\u003e 14. Korchagin Yu.A. Securities Market / Yu.A. Korchagin. - Rostov-n / D .: Phoenix, 2007 .-- 496 p.

OTC Market

(Curb market)

OTC Securities

OTC transaction and system, the most famous OTC platforms

Section 1. The concept of the OTC market.

OTC Market — This term is used to describe any transactions concluded outside the exchange. OTC Market It can also be a market network of dealers selling and buying securities. On the over-the-counter market, it is possible to conclude contracts with securities using the internet.

OTC Market Concept

The OTC securities market is carried out through a network of intermediaries called dealers who have at their disposal a certain amount valuable papersto facilitate the implementation of investors trading orders. This way of doing business is more beneficial for dealersthan doing trade orders through others dealersas is the case in specialized stock markets such as.

The arguments in favor of this system are:

the OTC securities market has a high level of automation, which is provided by the “National Securities Dealers Association Automated Quotation System”. This system covers all countries with an automatic communication network that brings together dealers and brokers in the OTC market and provides them with information about securities that are sold through this system. The system is used for stock price quotes. In fact, the conclusion of the transaction occurs in the process negotiations on telephone set between broker and dealer.

An important point in the development of the OTC securities market was the use of large banks own electronic brokerage systems. They are distinguished by a low cost of providing services, the ability to trade during hours when traditional exchanges are closed, anonymity of quotes and a wide range of instruments that are traded. Such systems include Instinet, which operates globally, electronic communication networks such as Island and others. In the United States, there are about 20.

Over-the-counter market (Curb market) is

A tertiary securities market is a market where OTC trading of listed securities takes place. The tertiary market arose because it was unprofitable for institutional investors to trade on the stock market:

sufficiently large commissions, the minimum rate of which is fixed. Consequently, commissions often exceeded the marginal cost of conducting large-scale trading operations, while brokerage companies that are not members of the exchange did not set limits on commissions;

fixed time bidding, while in the OTC market operations continue even when they are suspended on the exchange.

The fourth securities market is the market on which contracts for the sale and purchase of any securities and even entire portfolios are established by institutional investors, bypassing exchanges and brokers.

In the USA, the conclusion of agreements on the “fourth” market is automated using the electronic stock trading system (Instinet).

The body that regulates the US securities market is the Securities and Exchange Commission - the state agreementse institution. The regulation of the securities market is based on federal and local laws. The principle of self-regulation is based on the federal regulation of the stock exchange:

The securities market is undergoing constant changes. On it you can do and lose money. investors need constant information and, if possible, reliable information about the market conditions of one or another paper.

It involves the placement of new monetary issues of securities by issuers. Here, long-term bonds and, to a lesser extent, stocks are mainly quoted, and buyers - both legal entities and individuals. Issuers may be corporations, the federal government, local governments; their role in the market is determined by the state of the economy in the country and the general level of its development. Chronic deficits of state budgets in a number of Western countries determine a rather large state borrowing in the securities market by money issue state bonds.

Buyers of securities - institutional and individual investors; the ratio between them depends both on the level of development of the economy, on savings, and on the state of the credit system as a whole. In developed countries, institutional investors dominate the securities market - insurance organizations, pension funds, investment firms (funds), private banks, etc.

The basis of the securities market is primary market; it is he who determines its combined scale and pace of development. However, primary markets in developed countries currently vary significantly. release shares on primary market in order to finance investments in production activities, it is exclusively associated with the establishment of new companies and the reorganization of private companies of various industries in the field of high technologies using risky or venture capital. The source of venture capital is large money funds that can afford to take risks. Most small firms originating in traditional industries economies do not fall on because they do not have a real opportunity to reach the scale that would allow them to issue shares.

the issue of shares in developed countries is currently due to financing the takeover (merger) of companies, the need to reduce the share of borrowed capital in the total capital of corporations. Acquisitions are carried out in the form of an exchange of shares of acquired companies for shares of absorbing companies; absorbing organizations actively enter the primary securities market by issuing money issues of new shares.

In some countries, the relationship between equity and debt is established by law. However, independently of the law, in each country there is a clear idea of \u200b\u200bthe maximum amount of borrowed funds. Moving beyond this line is fraught with significant risk for the company, and the organization regulates its capital structure by issuing securities of new shares, replacing them with its debt obligations.

At the present stage of development of the securities market, the monetary value of new shares in developed countries is very insignificant and is not always associated with the mobilization of free cash resources to finance the economy. The share of shares in the primary securities market is decreasing, and their role as a regulator of investments is decreasing.

Over-the-counter market (Curb market) is

Sources

Wikipedia - Free Encyclopedia, WikiPedia

invest-news.ru - Investment News

dic.academic.ru - Academician Dictionary

bibliotekar.ru - Librarian

forexua.com - currency market of Ukraine

bank24.ru - 24

OTC Market - See OTC Market Business Terms Dictionary. Akademik.ru. 2001 ... Glossary of Business Terms

OTC MARKET - an unorganized securities market in which their quotation is carried out not as a result of market factors, but by the company itself (self-quotation). Raizberg B.A., Lozovsky L.Sh., Starodubtseva E.B. Modern economic dictionary. 2 e ... ... Economic vocabulary

OTC Market - (over the counter market) the secondary market in which the purchase - sale of securities and other investment instruments is carried out decentralized (in contrast to the exchange market). Also called the unorganized market ... Economics and Mathematics Dictionary eBook

OTC (“street”) securities market (over-the-counter market; OTC market) - unorganized, where purchase and sale are carried out (mainly companies), transactions for which are not registered on the exchange. This market is characterized by a higher one (since many of the shares quoted on it did not go through the procedure on the stock exchange or were rejected to be quoted on the exchange during this procedure), lower level of legal protection of investors, lower level of their current awareness, etc.

OTC market is a way of organizing trading in the securities market by telephone and / or via electronic systems outside the exchange and, as a rule, with participation. On the OTC market, most of the shares and government, municipal and corporate bonds are traded.

The world's largest OTC market in the USA, NASDAQ in the mid-90s, covered about 1/3 of the total value turnover and the overwhelming number of shares circulating on the market (about 30 thousand issues of shares, including about 5 thousand - in active turnover )

In the UK, the OTC market is secondary, especially after the creation of the controlled market for unquoted securities at the London Stock Exchange in 1987.

The OTC market is developing as an alternative to the stock market. Less stringent listing and trading rules on the OTC market provide access to it for new issues of securities of various issuers, securities of small (sometimes also large) and venture companies. Many financial institutions have traditionally limited the circulation of their securities to the OTC market.

Unlike the always organized exchange market, where securities are traded according to firm exchange rules between licensed professional market participants, the OTC market can be organized and unorganized.

Organized OTC Market It implies the existence of firm rules and is based on computer systems of communication, trade and services, combining professional intermediaries in a single computer market. An example of an organized OTC market in the United States is the National Securities Dealers Association Automated Quotation System ( National Association of Securities Dealers ’Automated Quotations System,abbreviated NASDAQ), which is called the “second” market (the first market is the stock market) and provides several levels of access to information, and also determines the requirements for quoted shares (minimum shares outstanding, standards of declared capital and assets of the issuer, the presence of at least two dealers, etc. ) In 1997, the NASDAQ system included 5100 issues of various stocks (including 2900 of the most traded - in the National Market System NASDAQ / NMS), although in terms of trade in money terms this system is inferior to the New York Stock Exchange (while the NASDAQ system includes only part of the shares in over-the-counter transactions). The "third" market in the United States is called OTC trading of listed securities. The “fourth” OTC market is associated with direct trading in large quantities of securities between institutional investors without intermediaries (system Instinet) The international organized OTC market is the market.

Unorganized OTC Market (sometimes called the traditional or street market as opposed to the electronic computerized market) covers all other transactions (and how to organize them). As a rule, the determination of the terms of transactions and their conclusion occur directly between market participants on the basis of direct negotiations. For example, in the USA, in the so-called “pink sheets” daily information is published on stock quotes, and in the so-called “yellow sheets” - corporate bonds sold on the OTC market.

The OTC securities market is the first form of existence of the securities market from a chronological point of view. Trade on it was carried out spontaneously and was not regulated by anything. In the future, as financial relations developed, rules for conducting transactions with securities began to arise in various countries, which eventually led to the formalization of relations between participants in the securities market. The organizing link of partnerships in the OTC market is professional participants - brokers and securities dealers, who develop standards of behavior in the stock market, work out the rules and procedures that are applied when conducting transactions with securities. Over time, the widespread dissemination of standard rules and procedures for conducting transactions has led to the formation of professional performance standards. Professional standards of activity that market participants adhere to ensure the safety of participants in OTC transactions, which is especially important in the absence of a single trading center (stock exchange) that would take on such warranty functions.

The modern OTC securities market can be considered as a network structure in which there are centers of professional responsibility and random market participants, investors. Market development is guided by professionals and is provided by private investors. Consider in more detail the current functional structure of the OTC securities market.

Functional characteristics of the OTC securities market.

Among the main functions of the OTC market are the following:

- initial (initial) placement of securities, or issue;

- circulation of securities;

- redemption of securities;

- security of income on securities.

As part of the first function, it is customary to say that in the primary over-the-counter market, the reproduction process is financed by placing new issues of securities, including bonds of commercial and industrial corporations. Issuers in this market are enterprises and organizations (public joint-stock companies, corporations), which, with the assistance of financial institutions, issue securities and place them among large institutional investors with long-term reserves of funds (insurance companies, investment companies, private pension funds, commercial banks).

The huge needs for issuing new issues of securities in connection with the development of fixed capital renewal processes in the 1960s led to an increase in the importance of over-the-counter primary turnover. Rising inflation in the late 1950s - early 1960s. also gave a powerful impetus to the development of the OTC securities market, as institutional investors began to use shares for inflation insurance. Shares were purchased in large batches in order to get around lowering commission costs on stock exchanges.

To date, special methods of trading securities have been developed in the OTC primary securities market. Among them, the most common are underwriting, direct placement, public offering, competitive bidding. The main role in their application is played by investment and commercial banks, banking houses, brokerage firms, which act as the main intermediaries in the placement of securities.

The most common method is underwriting, which is understood as a “subscription” to securities conducted between the issuer and the investor. As a rule, investment (for example, in the USA and Canada) or commercial (for example, in Germany) banks act as the initial investor. These banks play a leading role in the sale of private bonds. The fee for this is a commission in the amount of a fixed percentage of the value of the bond loan. The parameters of the issue are specified in the issue agreement, which is concluded between the issuing company and the investment bank. A feature of underwriting is that the investment bank assumes financial responsibility for the placement, as it redeems the entire issue of securities. The issue agreement makes a “exit from the market” clause to minimize banking risk in the event of extremely unfavorable developments in the market.

In turn, investment and commercial banks organize issuing syndicates, i.e. a placement group, according to one of two principles: “split account” or “split account”. Application of the principle of “separate account” allows you to share financial responsibility for the results of the placement between other participants in the syndicate who are responsible within their participation and the share of the allocation allocated to them. The principle of “inseparable account” implies collective responsibility for the placement of the entire issue in proportion to the size of its participation. In both cases, as a rule, special sales groups are formed, consisting of credit institutions conducting securities purchase and sale transactions. Members of such trading groups are trading agents and do not assume financial responsibility. They undertake obligations to sell a certain amount of securities, receiving commissions or margins for this.

The main financial instruments of the OTC market are bonds. Initial placement of new bond issues is carried out on the OTC market, only then the latter fall into the exchange turnover. At the same time, the bulk of new bonds does not fall into secondary circulation, but remains in the investment portfolios of credit and financial institutions. Also, over-the-counter primary markets place equity issues.

Modern organized over-the-counter securities markets are auction-type systems with vowels, bidding and telecommunications equipment. Certain rules apply in such markets; licensed professional intermediaries act as market participants.

We analyzed the opinions of experts regarding the relationship between the exchange and over-the-counter markets. According to experts, the OTC market is larger than the stock market in terms of quantity. This is due to the fact that a large number of issues of securities regularly enter the OTC market. In terms of value, the exchange market is larger than the OTC market, which is associated with a constant increase in market capitalization.

Despite the fact that the volume of primary markets in different countries varies, everywhere it is the basis of the securities market as a whole. In recent decades, the active development of the primary over-the-counter market has been associated with an increase in financing of investments in manufacturing activities, the emergence of new companies and the reorganization of private companies in various sectors of high technology using risky or venture capital. Shares of such companies are bought up by venture capital funds with sufficiently large capital. In terms of raising capital, companies in traditional industries lose out.

The OTC market is essentially an environment in which financial intermediaries operate that attract private and corporate investors in the securities market. The OTC market is characterized by heterogeneity of composition, disproportionate structure, so, a minimum of intermediaries account for a huge mass of investors. OTC transactions, as a rule, are quite large, but they are not massive. Basically, they are held to redistribute shares between minority shareholders, or to ensure minority control of the company. At the same time, individual investors, owners of small capital with the aim of buying or selling securities, can only turn to the OTC market.

We consider the OTC securities market as a complex system of trade and economic relations between investors, issuers and intermediaries, ensuring the initial and subsequent circulation of securities, creating conditions for the market promotion of securities, determining investment demand and establishing a fair market value for assets or public joint-stock debt companies.

Characteristics of an organized OTC securities market. Principles of organizing over-the-counter securities trading.

The pattern of development of organizational forms of the stock market is the gradual penetration of exchange trading methods into over-the-counter trading, which is facilitated by the development of modern information technologies. As a result, the differences between the exchange and over-the-counter forms of securities trading are blurred, transitional forms appear. This movement comes from the OTC form of organization to the exchange form. From over-the-counter turnover, modern securities trading systems arise, based on up-to-date means of communication and computer technologies. They are close and largely repeat modern exchange trading systems. Figuratively, they can even be compared with a geographically distributed electronic exchange. Of course, they have their own rules for organizing trade

The principal features of OTC organized trading are:

1) transactions with securities are carried out in the electronic trading system, access to which are available to the buyer or seller. They are recorded in the system, and information processing is carried out centrally in the trading system;

2) OTC organized trading is carried out in batches of securities;

3) OTC organized trading takes place regularly in the daytime;

4) OTC transactions are closed. Information on traded shares: their form, quantity and quotes is presented in the system only for its participants;

5) free pricing implies the satisfaction of applications for the purchase and sale of securities at the best price offered, as well as in exchange trading. The bid prices are set independently by bidders, and, in coincidence with the bid price, a deal is conducted;

6) OTC organized trading is carried out in accordance with the Rules approved by the trading system;

7) OTC trading is conducted both with and without intermediaries.

Within the framework of OTC organized securities trading, a number of operations are carried out, which can be grouped as follows:

- Trading transactions (purchase and sale of securities);

- Securities valuation procedures (identification of the rate, current quoted price);

- Procedures for admitting securities to trading in the system.

Thus, the list of operations on the organized OTC securities market is much narrower than on the stock market, therefore, participants in the OTC market are less protected from dishonesty of partners than participants in exchange trading, whose transactions are actually guaranteed by the exchange.

Agreements between parties involved in the OTC trading system are called OTC trading transactions. OTC transactions are mutually agreed actions of participants in an (OTC) trading system aimed at establishing, terminating or changing their rights and obligations in relation to securities. As on the modern exchange, they are executed in the electronic trading system during their conduct (over-the-counter trading sessions).

In over-the-counter trading, the trading system is a place where, subject to certain rules, the fact of a transaction between participants is recorded, and the trading system itself acts as an independent arbiter in the transaction. The central place in the structure of the organization of the OTC market is occupied by the system of trade rules, control over their implementation and disciplinary measures implemented by the organizer of the OTC trade.

In connection with the systematization of the OTC market and the widespread use of highly efficient means of communication, the value of the exchange and exchange mechanisms for buying and selling stock values \u200b\u200bis gradually decreasing. The main competitors of the exchange in this sense are commercial and investment banks, which are gradually turning into settlement centers for trading in stock values. New forms of organizing over-the-counter turnover using computer equipment and communication channels are increasingly declaring themselves.

In the process of concluding and executing over-the-counter transactions, market participants realize the most important function of the securities market - redistribution. It provides an effective redistribution of financial resources between sectors and sectors of the economy.

The history of the development of the Russian organized OTC securities market.

Considering the structure of the Russian OTC securities market in the 90s of the XX century, we note the following components:

- government securities trading system;

- trading network of a savings bank;

- oTC securities market of commercial banks;

- electronic OTC markets;

- russian trading system (RTS "PORTAL"), organized by the professional association of stock market participants (PAUFOR).

The OTC turnover organizational center was the non-profit partnership “Russian Trading System” (NP “RTS”), which united Russian brokerage and dealer companies. The partnership was created in 1995 to form a platform for organizing and regulating over-the-counter securities trading. The agreement on the formation of an OTC electronic trading system for RTS was reached by leading stock market operators in May 1994. The need for such an agreement was due to the fact that exchanges in the early 1990s did not show interest in trading stocks. At the same time, there was a need to create an organized platform for trade with them in order to create a liquid market with the necessary guarantees for its participants. Such a platform was created by members of the PAUFOR association, who voluntarily pledged to adhere to mutual agreements, the rules of information transparency and a single document flow. To service the OTC stock market, they chose the American PORTAL system. It was modified for the Russian market in such a way that it began to represent a two-way communication between users who were in their offices and a central server. At the end of 1994, the system was installed in brokerage firms - members of PAUFOR and conducted the first test bidding.

Initially, the PORTAL performed informational functions, since most of the quotes displayed in it were indicative and non-binding. In May 1995, indicative prices were canceled, quotes set out in the system became mandatory and regular stock trading began. Initially, trading was carried out by several dozen companies with securities of seven issuers.

In the summer of 1995, the system was improved and replaced with RTS. Initially, the system served 50 traders working from remote terminals. Subsequently, other regions of Russia joined the RTS, and members of other self-regulatory organizations began using it: the Association of Stock Dealers of Siberia, the St. Petersburg United Trading System, the Ural Association of Brokers and Dealers.

The trading technology on the RTS was as follows: system members — bidders from remote terminals entered their proposals for the purchase and sale of shares into the central computer. Entered offers appeared on the terminals of all bidders. To complete the transaction, the bidder had to contact the trader who submitted the application by phone and agree with him on the transaction. The subsequent settlement procedure for the transaction and re-registration of property rights were carried out by the partners in the transaction on their own. Subsequently, these duties were assigned to the Depository Clearing Company (DCC), with which RTS, NAUFOR and a number of large investment companies entered into a multilateral agreement.

All RTS participants were divided into categories. (see table. No. 1)

Table No. 1. “Classification of RTS Participants”

Description of the basic rules of trade in the RTS:

- all offers (quotes) entered into the system were “solid”, i.e. binding on performance;

- the minimum lot size that could be set in the system is 10 thousand dollars. USA;

- participants in the system are obliged to execute and guarantee the execution of the transaction on certain conditions;

- participants in the system are obliged to resolve all disputes by initial appeal to the NAUFOR Arbitration Court;

- to be eligible for quotation, securities must be listed. A quotation committee was constantly operating in the RTS, which calculated the securities included in the quotation list of the first level. The quotation list of the first level was calculated on the basis of actually concluded transactions for certain securities and was a kind of indicator of the liquidity of the stock.

In OTC organized trading on the RTS, transactions were concluded on a “delivery versus payment” basis at the settlement date or on a free delivery basis. Preliminary deposit of funds or securities was not carried out. Depending on the agreement of the counterparties, this could be an advance payment or pre-delivery.

The RTS information station via the Internet made it possible to receive in real time a complete list of quotes for each paper; list of trade participants; list of securities; list of transactions concluded in the system; trading volume and RTS indices. The RTS Gateway software presented the automated systems installed at the bidder with the functions of bidirectional information exchange with the trading system. Through RTS Gateway, current market information was transmitted from the trading system, and, by agreement with news agencies, news feeds were broadcast to customers; in the opposite direction, information was transmitted about applications, reports on customer transactions. Applications submitted through the RTS Gateway were signed by electronic digital signature of bidders.

Starting from 1995, the RTS Index has been calculated based on prices formed on the classic stock market, which has become (along with the MICEX index) one of the main indicators of the Russian stock market. The RTS Index is calculated based on quotes of 50 securities of the most capitalized Russian companies.

According to brokers, by the end of 1995 no more than 10 - 15% of all transactions with shares of privatized enterprises were made through RTS (about 50% of the turnover went through large Moscow brokers - founders of PAUFOR through RTS). However, a number of objective reasons led to the fact that by the 2000s, RTS had become the main trading platform for corporate securities, through which about 80 - 90% of the total Russian stock trading volume passed. So the classic RTS stock market was created.

In early 2000, the RTS received a stock exchange license. The main object of trade transactions on the RTS was the shares of major Russian enterprises, such as RAO UES, RAO Norilsk Nickel, AO Yuganskneftegaz, and NK Lukoil. At the same time, by 2010 there was an increase in the total turnover of investment companies due to the outstripping OTC segment of the investment business outstripping the development. At the end of 2009, investment companies showed total trading volumes in the OTC market at the level of 7.4 billion rubles, which amounted to 20% of the total turnover of companies. In 2010, a systematic increase in securities trading led to an increase in the share of the OTC sector to 23% in the total turnover of companies.

After the RTS OTC market received stock exchange status, the organized OTC securities market in Russia lost its organizational core. This is largely due to the development of processes of concentration and centralization of stock trading.

Nevertheless, the experience of developing developed organized securities markets suggests that OTC organized trading systems occupy a significant place in the securities market and they have a great future. Consider the standard organizational structure of the OTC market system.

Organizational structure of the OTC securities market system.

Fig. 1 "Organizational system of the OTC securities market."

OTC trading in securities is not spontaneous. OTC turnover has its own organizational system. The main infrastructure elements of an organized OTC securities market are:

- a depository that performs the functions of a settlement center with a wide range of depositary operations, including operations “delivery / receipt of securities against payment”;

- one or more leading market makers that offer quotes and support the market;

- information and trading system (s) for receiving / quoting and concluding transactions (for example, Bloomberg b Reuters Dealing);

- general terms of trade and settlements, including the procedure for concluding transactions, the size of the minimum lot, the timing and procedure for settlements (T +?).

To date, the Euroclear system is a clear example of the international OTC market. Clients who have opened custody accounts with a depository (custodian bank), at the Euroclir international depositary clearing center, conclude bonds purchase and sale transactions on a bilateral basis (usually using the Reuters-dealing system). Having received confirmation of the transaction, counterparties must send instructions for settlements to their depositories. In this case, both counterparties can be serviced in one or different depositories. There are no fundamental differences in terms of settlement time, regardless of whether the counterparties are customers of one or different depositories.

In the latter case, upon receipt of instructions from customers, the depository under the system S.W.I.F.T. send their own instructions to EUROCLIR. For these purposes, the Euclidean remote access system proposed by Euroclear may also be used. The client of the depository account in Euroclear has a dual status - this is a custody account, and at the same time a cash account. To conduct an operation in the form< поставка/ получение против платежа > the buyer of securities must promptly transfer the required amount of the payment currency to reinforce the cash account in EUROCLIR.

EUROCLIR Settlement Processing Center automatically accepts incoming orders S.W.I.F.T. and performs their processing on-line. On completed transactions, a confirmation is instantly generated on the settlement day, and S.W.I.F.T. - a message indicating the reasons for non-compliance. One of these two documents is immediately sent to the depository, which has the opportunity on the same day to send the client a report on the execution of his order. Operations can also be performed on the same day if several orders were sent from the client to conduct a series of operations “delivery / receipt against payment” or “delivery / receipt free of payment”, which is convenient for active market participants.

Conclusion

Summing up the above, we note that modern financial markets as a whole are characterized, firstly, by the expansion of the area of \u200b\u200borganized markets due to the emergence of over-the-counter trade organizers and, secondly, by increased international competition among exchanges. In response to this, liquidity is concentrated on large exchanges, cross-border consolidation of exchanges and the consolidation of national exchanges within a single country. A characteristic feature of the Russian financial market is the presence of significant volumes of OTC transactions, including due to an increase in the volume of transactions concluded between the clients of one broker. In this regard, the urgent task is to regulate not only exchange institutions, but also the organized market as a whole, regardless of the form in which it exists. In order to further improve the structure of the Russian securities market, in our opinion, it is necessary to develop over-the-counter markets by introducing modern forms of organized trading. This will contribute to the high-tech development of the Russian market and its active integration into the global securities market system.

The idea of \u200b\u200bgetting rich through the resale of financial instruments, such as stocks or currencies, seems very attractive. With the development of the Internet, it has become especially widespread. Numerous brokers and dealers attract an inexperienced client and promise. At the same time, some actively advertise in pairs on Forex, while others are campaigning to invest in the Russian stock exchange market, that is, to buy shares of domestic companies. Many believe that the difference between these sites is only in the tools available for trading. In fact, this is just the tip of the iceberg. But in order to understand everything, you will have to go a little deeper into economic theory.

What are the markets?

As part of the global, it is customary to distinguish several main segments: stock (including urgent), foreign exchange, insurance, investment. For the ordinary investor (trader), the first two segments are of interest, while all the others are for professionals. On the stock market, primary securities are traded - stocks and bonds. Derivatives market is the place of circulation of derivatives - derivatives, forwards, options, swaps). In the foreign exchange market, as its name implies, a currency is exchanged.

What are stock and over-the-counter markets?

Depending on how the process of circulation of financial instruments is organized, it is customary to divide the markets into exchange and over-the-counter. If we consider the stock, derivatives or exchange and OTC segments are in each of them.

A stock market is an asset trading organized by a stock exchange. It establishes the procedure for bidding and settlements, a list of traded instruments and other rules. Counterparties look for each other inside the exchange platform through their brokers, and the exchange acts as a guarantor when concluding a transaction. The exchange is a legal entity that has an address for tendering and a mode of operation. Previously, “coming to the exchange” meant literally coming to this site and making deals with other traders live. Now everything has been greatly simplified - the exchange trading market has become almost completely electronic. However, the main task of the exchange remained the same - to organize tenders and act as a guarantor of the transaction.

The OTC segment of any market exists outside the exchange and is much less regulated. OTC market is not tied to any platform and exists virtually. In some ways, it can be called more free. At the same time, the parties do not have any third party guarantees that the asset will be transferred to the buyer, and the funds will be transferred to the seller.

Exchange Trading

Encouraging future investors to transfer money to the stock market, brokers mean the exchange. Although theoretically you can buy shares directly from the owner - a private individual or company. However, this is due to the mass of inconveniences, ranging from searching for a counterparty and ending with documenting. The exchange trading market assumes that all these concerns are taken over by the exchange.

The interests of the client on the exchange are represented by a broker. He receives instructions from a trader through a special program (trading terminal) and conducts the corresponding operations. The quotes that the trader sees in his terminal are real deals or requests from other traders. They will be the same if you open, say, several terminals from different brokers.

Thus, the exchange trading market provides a private trader with access to the global trading platform, where he can carry out transactions with other such traders. Neither the exchange nor the broker is interested in any of the merchants making or losing money. Their business is built on the receipt of commission deductions that bidders pay, regardless of their outcome.

FOREX - OTC Currency Trading

Unlike the stock exchange market where stocks are traded, FOREX is its OTC counterpart. This is a global currency trading market in which mainly central banks of different countries and other financial institutions participate. Small participants join large ones through a number of intermediary organizations. A private trader for trading on FOREX goes to a dealer - a company whose functions are similar to the functions of a stock broker. Outwardly, everything looks approximately the same - the same trading via the Internet, the same placing applications for purchase and sale.

But there are moments that fundamentally distinguish the exchange trading market from FOREX. The fact is that in most cases, a FOREX dealer does not display a client’s application for a global over-the-counter platform where large banks trade currency. This is simply not possible since the lots in this market are measured in thousands or even millions. The dealer brings its customers to its own mini-market, and most often acts as a counterparty itself. It turns out that the trader is trading against his dealer. At the same time, the latter shows quotes of currencies, which it also sets independently. They are close to the real FOREX quotes, but differ in the direction disadvantageous for the client.

It turns out that the FOREX dealer is a large currency exchange point: it sets quotes and acts as one of the parties to the transaction. It is easy to guess who will benefit as a result.

Legal moment

Exchange activity in Russia has been subject to licensing since the mid-90s - now the Central Bank is engaged in this. Serious requirements are imposed on license applicants, including authorized capital in the amount of millions of rubles, which indicates the reliability of the mechanism for accessing the stock market through a broker. In addition, they do not have access to the money and shares of their customers - all assets are stored in special accounts on the exchange.

But FOREX dealers, the Central Bank is only trying to take control. Recently, their activities are also licensed, but there are only a few companies that have received the appropriate license. Others simply bypass the law - they work through offshore companies. Thus, to trade on FOREX, a trader transfers his own funds to a company registered, probably somewhere in or in Cyprus.

What about a trader who, in spite of everything, still wants to trade currency? Of course, no one can forbid a person to try his hand at FOREX. The main thing is to carefully choose a dealer from among the largest and not risk large sums. But a more reliable way is to go to the Moscow Exchange, in the derivatives section of which you can buy and sell futures for some currency pairs.